A MODIFIED PRICE MODEL ACCOUNTING VALUE RELEVANCE

It means that investors and market analysts get a reasonable idea of the companys worth. February 06 2022 Activity-based costing common in manufacturing facilities takes into account the overhead costs of running the factory.

What are Cost Models.

. Indices are demonstrably uncorrelated with recent indications of fair valuation. We use Ohlsons model to examine the value relevance of earnings management. This information appears as an asset on the balance sheet of the investor.

As an example let Company A have 22 million dollars of cash from its business operations. Although some scholars believe that the value relevance model indicates that accounting information is relevant and reliable faithfully represented it is however difficult to attribute the cause of the lack of value relevance to the relevance or the reliability aspects as the value relevance model does not distinguish between relevance and. That model is fair.

This thesis investigates the link between earnings management and firm valuation by assessing the impact of earnings management on the value-relevance of earnings and book value. The sample of this study is firms listed on the Main Board of Bursa Malaysia from year 2001 to 2007. Researchers carrying out earnings management research usually rely on the Jones 1991 or the modified Jones model 1995 to disaggregate accruals into its discretionary and nondiscretionary components.

In this paper we first discuss this valuation framework identify its key features and put it in the context of prior valuation models. A firms pricing model is based on factors such as industry competitive position and strategy. The authors provide empirical evidence based on unique Canadian environment that accounting information prepared and disclosed under IFRS exhibits higher.

This model expresses market price per share MP as a function of both earnings per share EPS and book value per share BVPS. The figure is determined using historical company data and isnt typically a subjective figure. Price quotations dont reflect current information.

In contrast the price model measures the mean annual information content of the explanatory variables for the dependent variable in levels. In accounting and finance fair value is a rational and unbiased estimate of the potential market price of a good service or asset. One type of accounting information that can be provided is discretionary accrual proxy for earnings management.

The work of Ohlson 1995 and Feltham and Ohlson 1995 had a profound impact on accounting research in the 1990s. Kothari and Zimmerman 1995 argue that the price model may produce biased results if the variables used follow a random walk. 10 Many indicate they are only providing information for standard setters to weigh along with other relevant factors see Barth.

Osmand Vitez Last Modified Date. A historical cost concept is a strategy used in accounting that values assets at their original cost. A clear distinction is also to be made to the carrying costs and the values that will have to be considered in the reporting that is done for the financial year.

Supply and Demand iii. Fair value accounting c. Cash Flow Cash Flow CF is the increase or decrease in the amount of money a business institution.

This study estimates discretionary accruals using the Modified Jones model with ROA Kothari 2005 as earning management proxy. Book value is considered important in terms of valuation because it represents a fair and accurate picture of a companys worth. Hence the objective of the study was to empirically test using price regression model based on a re-modified.

Once the investor records the initial transaction there is no need. Under these circumstances the cost method mandates that the investor account for the investment at its historical cost ie the purchase price. If a quoted market price is not available preparers should make an estimate of fair value using the best information available in the circumstances.

Value Relevance of Accounting Information in the Pre- and Post-IFRS. Fair value is a development of the classical historical cost accounting. The investment has no easily determinable fair value.

Which two economic concepts are fundamental to the relevance of fair values to accounting. See how ease of access consistency and. Used in the present study to determine the value relevance of accounting information.

A pricing model is a structure and method for determining prices. Fair Value and Cost Accounting Depreciation Methods Recognition and Measurement for Fixed Assets Anastasios Tsamis1 Konstantinos Liapis2 Abstract. For example a vineyard that produces small batches of grapes known for their unique terroir may charge a premium priceWhereas an agricultural firm that has established cost leadership in grape.

We develop an accounting-fundamentals-based measure of the markets pricing of riskthe difference between actual share price and a residual income valuation model estimate of. The authors use multiple models including a model similar to the Ohlson 1995 model and a modified Balachandran and Mohanram 2011 model to investigate value relevance in the period 2008-2013. The Efficient Markets Hypothesis ii.

This model is used when the estimating the fair value of the asset is possible and thus the carrying costs for the company can be estimated correctly. The following Value Relevance Models have been used to assess the value relevance of accounting information. Most information needed to compute a companys FCF is on the cash flow statement.

This study examines the impact of IFRS adoption on the value relevance of accounting information. This paper investigates the impact of earnings management on value relevance of accounting information in the context of Japan. Markets are highly efficient.

Value relevance research suggests which measurement model best links share price and accounting information. The International financial reporting standard IFRS was adopted for being a higher quality standard than SAS which was previously used. Most value-relevance researchers do not argue that either the book value of equity or earnings should be an estimate of equity market value or a measure that can be transformed into an estimate of equity market value.

According to the Financial Accounting Standard No. Accounting studies testing market efficiency have conclusively found that a. 157 titled Fair Value Measurements fair value is the price at which.

Historic cost accounting d. Both a return model Easton and Harris 1991 and a price model modified by Ohlson 1995 Accounting information has value relevance to investors. On the other hand cost.

Cost models help business owners and managers figure out the cost for certain activities and processes. 2005 The paper examines whether the financial statements prepared under the shareholder model provide better information than information provided under the stakeholder model. If available a quoted market price in an active market is the best evidence of fair value and should be used as the basis for the measurement.

Importance of Book Value. Fair Value Accounting. Free Cash Flow Operating Cash Flow CFO Capital Expenditures.

Threat Of New Entrants One Of Porter S Five Forces Threat Porter Force

Coupon Rate Accounting And Finance Economics Lessons Learn Economics

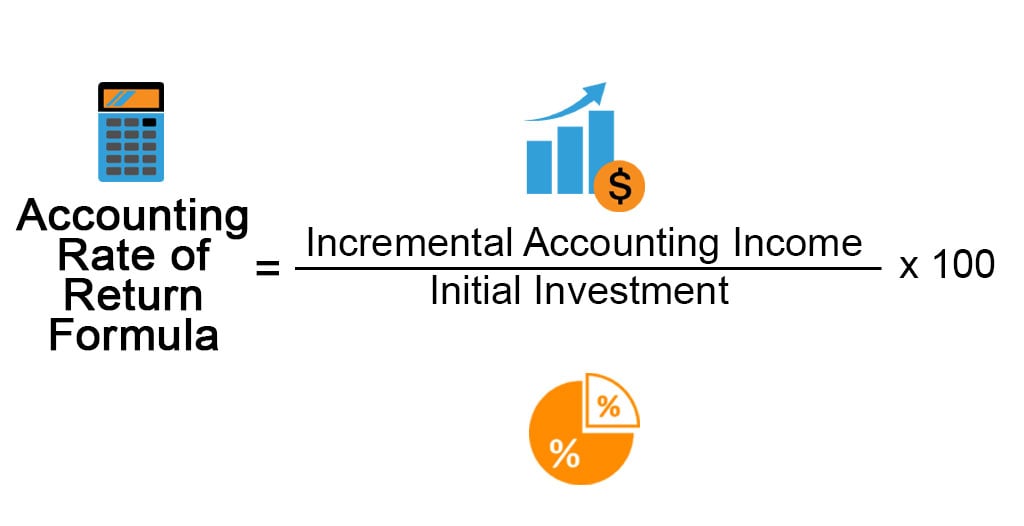

Accounting Rate Of Return Formula Examples With Excel Template

Mckinsey 7 Step Problem Solving Process Problem Solving Problem Solving Activities Problem Solving Worksheet

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

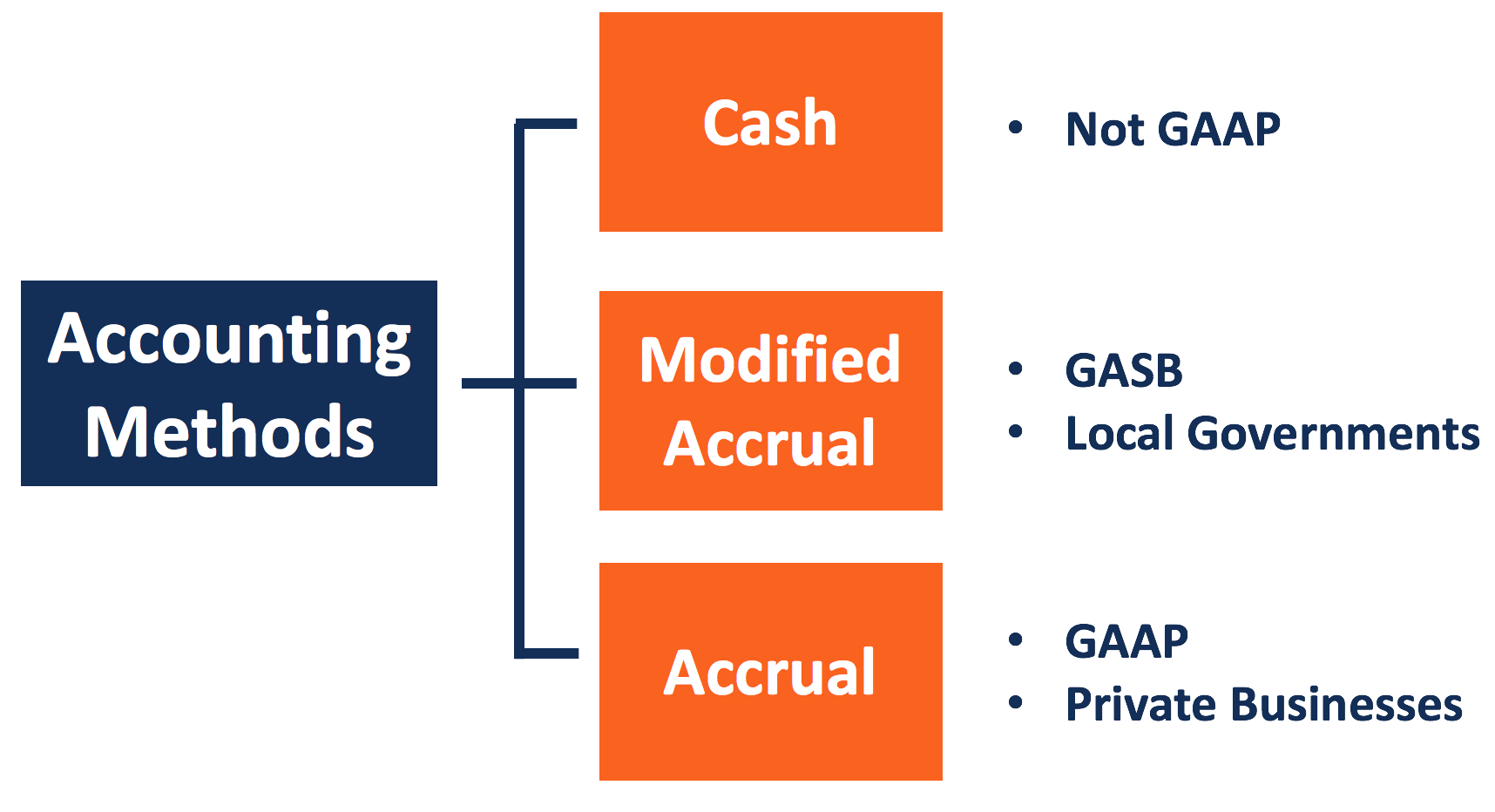

Modified Accrual Accounting Overview And Basic Rules

Well Written Sops And Continuous Improvement Standard Operating Procedure Standard Operating Procedure Template Writing Standards

Supplier Power One Of Porter S Five Forces Force Power Porter

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

0 Response to "A MODIFIED PRICE MODEL ACCOUNTING VALUE RELEVANCE"

Post a Comment